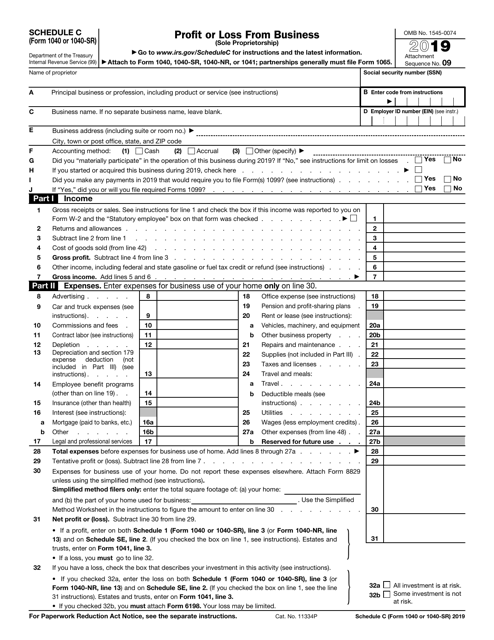

schedule c tax form 2020

Include pictures crosses check and text boxes if needed. It is used by the United States Internal Revenue Service for.

1040 Schedule C Form 2018 Fill Out Sign Online Dochub

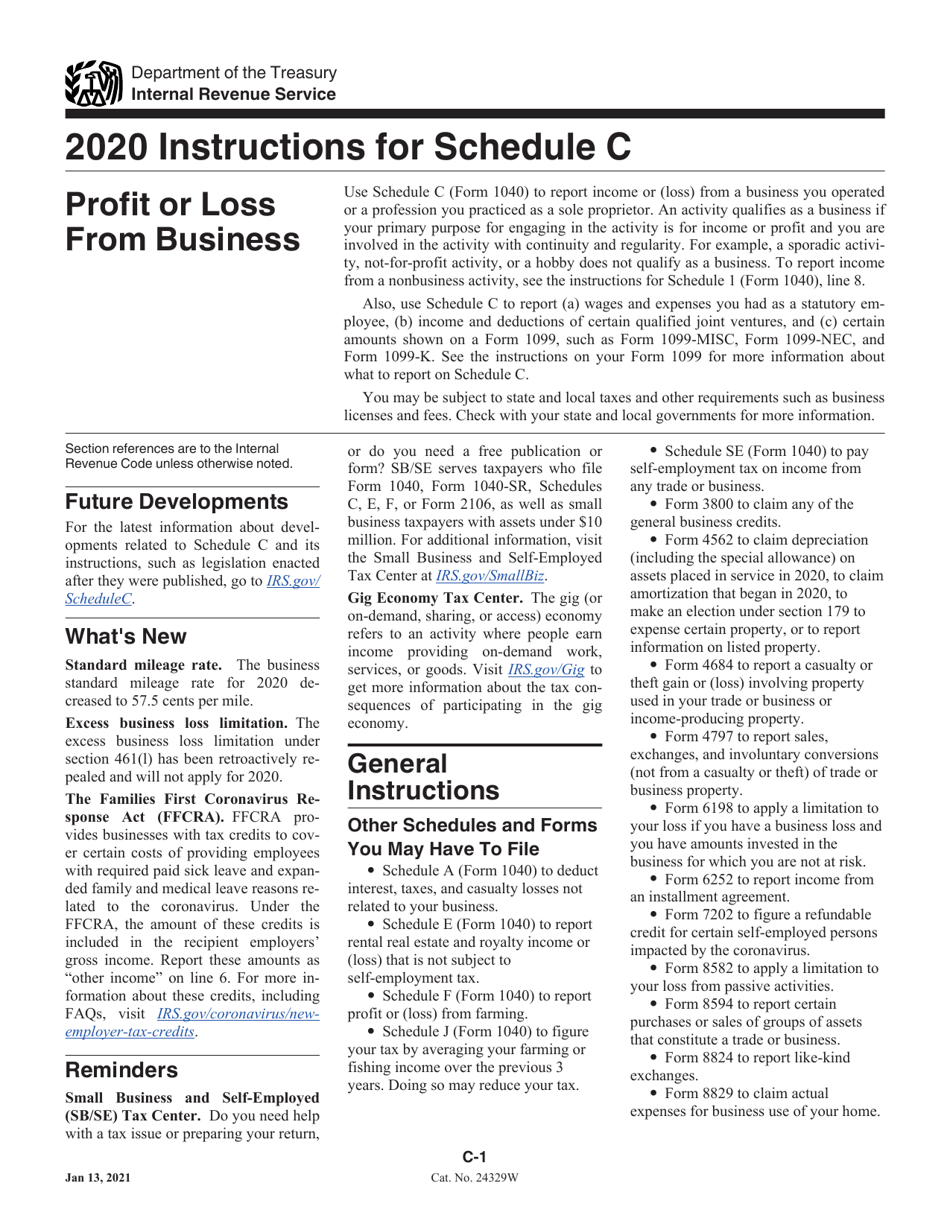

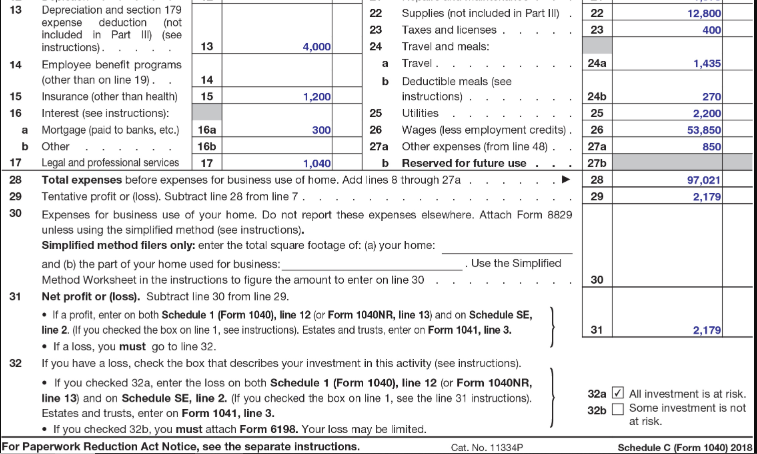

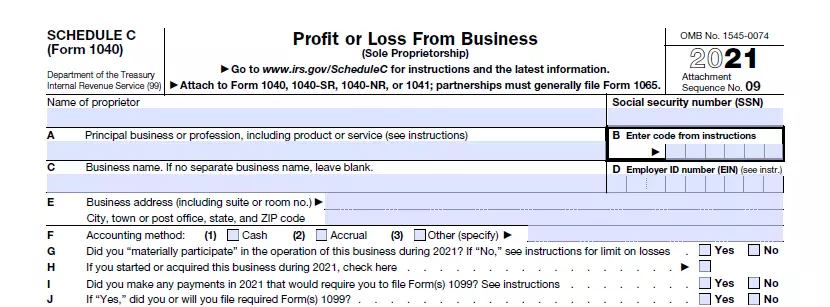

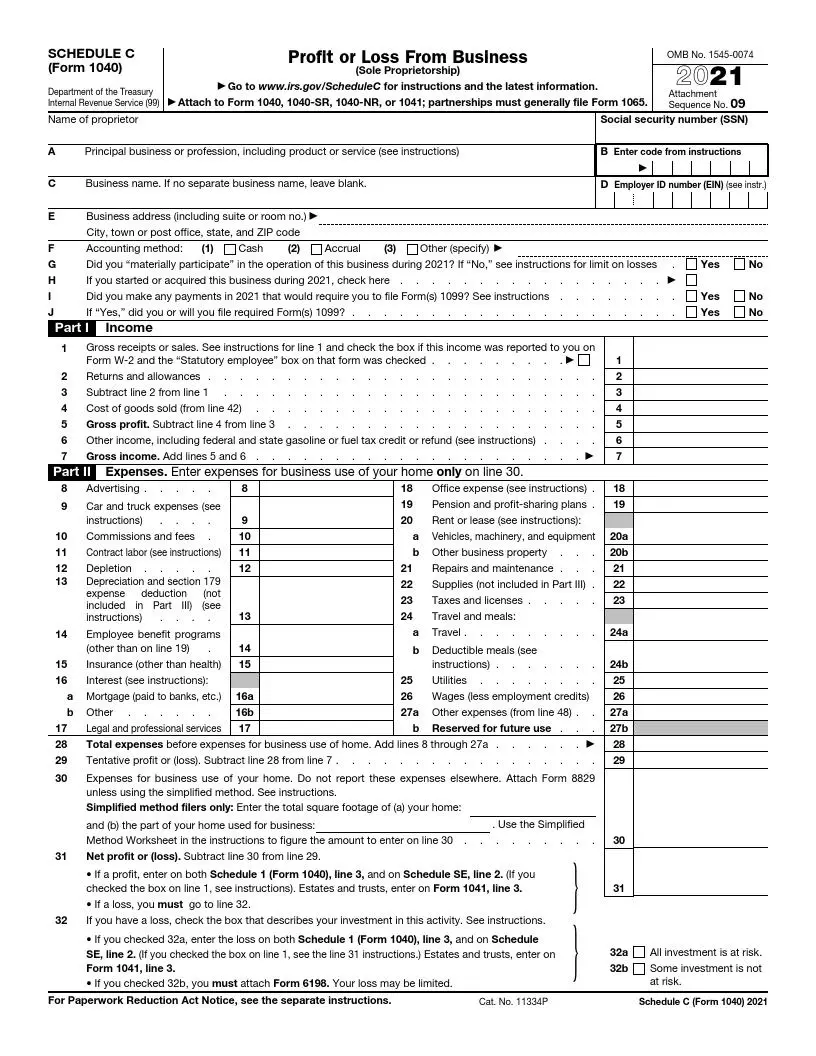

Use Schedule C Form 1040 to report income or loss from a business you operated or a profession you practiced as a sole proprietor.

. Form 1040 due to the Taxpayer Certainty and. Schedule F Form 1040 to report profit or loss from. 9 rows Instructions for Schedule C Form 1040 or Form 1040-SR Profit or Loss From.

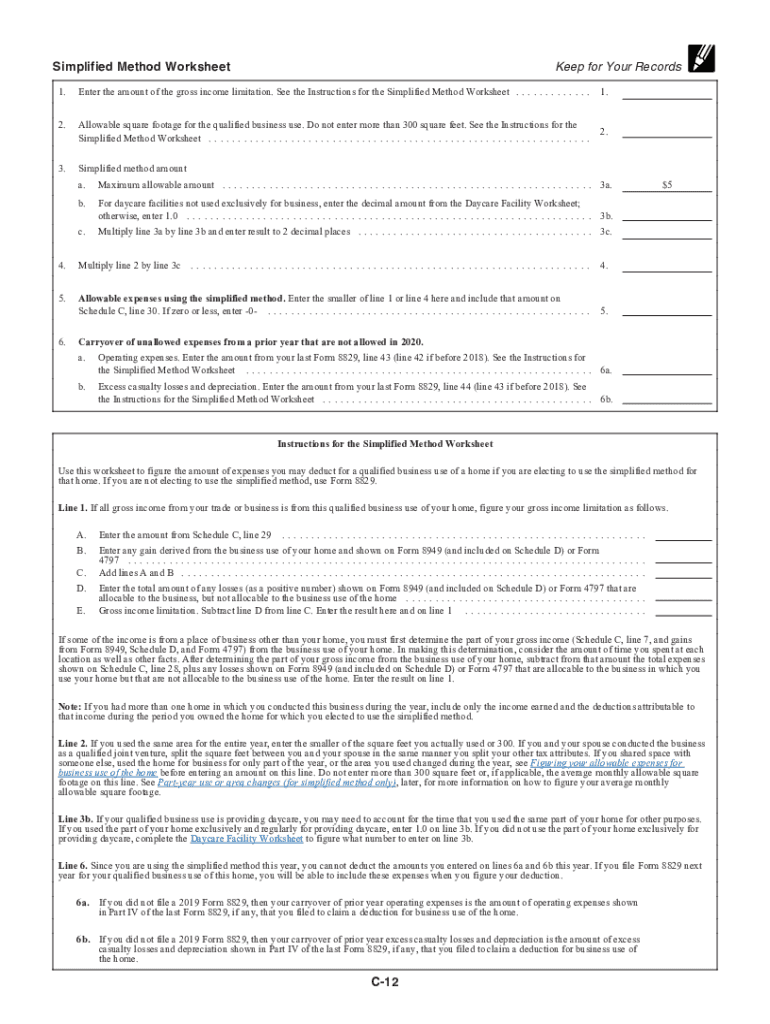

Fill in the details required in IRS 1040 - Schedule C using fillable fields. 2020 Tax Return Forms and Schedules for January 1 - December 31 2020 can be only be paper filed now - FileIT. Open the record with our advanced PDF editor.

However the COVID-related Tax Relief. Go to line 32 31 32. January 1 - December 31 2020.

Fill in if you made any payments in 2020 that would require you to file Forms 1099. IRS Schedule C Profit or Loss from Business is a tax form you file with your Form 1040 to report income and expenses for your business. Click on column heading to sort the list.

Form 1041 line 3. Massachusetts Profit or Loss from Business. If you checked 32a enter the.

Use Schedule C Form 1040 to report income or loss from a business you operated or a profession you practiced as a sole proprietor. IRS Income Tax Forms Schedules and Publications for Tax Year 2020. Schedule E Form 1040 to report rental real estate and royalty income or loss that is not subject to self-employment tax.

98 rows Click on the product number in each row to viewdownload. If a loss you. The Schedule C form is generally published in October of each year by the IRS.

You must make an appointment for assistance at the local. You had until October 15 2021 to e-File 2020 Tax Returns. The resulting profit or loss is typically.

You may be able to enter information on forms before saving or printing. Fill in if you. A Schedule C is a supplemental form that will be used with a Form 1040.

You fill out Schedule C at tax time and attach it to or file it electronically with Form 1040. Schedule C is typically for people who operate sole proprietorships or single-member. To obtain a permit file Form 1040-C or Form 2063 whichever applies with your local IRS office before you leave the United States.

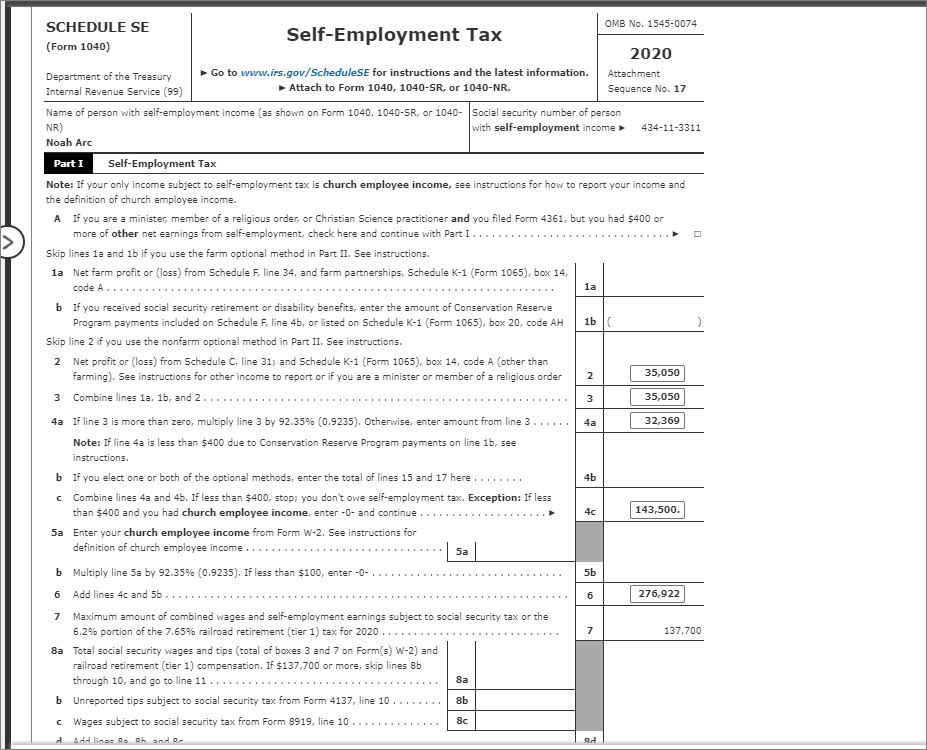

Shareholders Aggregate Foreign Earnings and Profits. Usually people who file a Schedule C Tax Form will also have to file a Schedule SE Tax Form. Use Schedule C 100S to determine the allowable amount of tax credits to claim on the 2020 Form 100S California S Corporation Franchise or Income Tax Return and the credit carryover.

2020 Tax Returns were able to be e-Filed up until October 15 2021. You may also need Form 4562 to claim depreciation or Form 8829 to. If published the 2022 tax.

If you have a loss check the box that describes your investment in this activity. Schedule C instructions follow later usually by the end of November. This form is known as a Profit or Loss from Business form.

26 rows Form 965 Schedule C US.

Download Instructions For Irs Form 1040 Schedule C Profit Or Loss From Business Pdf 2020 Templateroller

A S E F G H E No Oms No 1545 0074 Schedule C Profit Chegg Com

Solved Schedule C Form 1040 Profit Or Loss From Business Chegg Com

Irs Form 1040 1040 Sr Schedule C Download Fillable Pdf Or Fill Online Profit Or Loss From Business Sole Proprietorship 2019 Templateroller

Solved Schedule C Form 1040 Profit Or Loss From Business Chegg Com

1040 Schedule C Form Fill Out Irs Schedule C Tax Form 2021

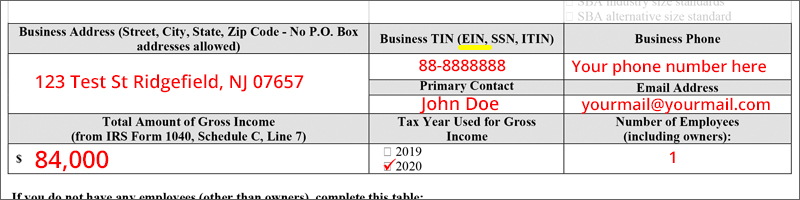

New Self Employment Gross Income Ppp Loan Application Guide

Solved Schedule C Form 1040 Profit Or Loss From Business Chegg Com

2020 2022 Form Pa Pa 40 C Fill Online Printable Fillable Blank Pdffiller

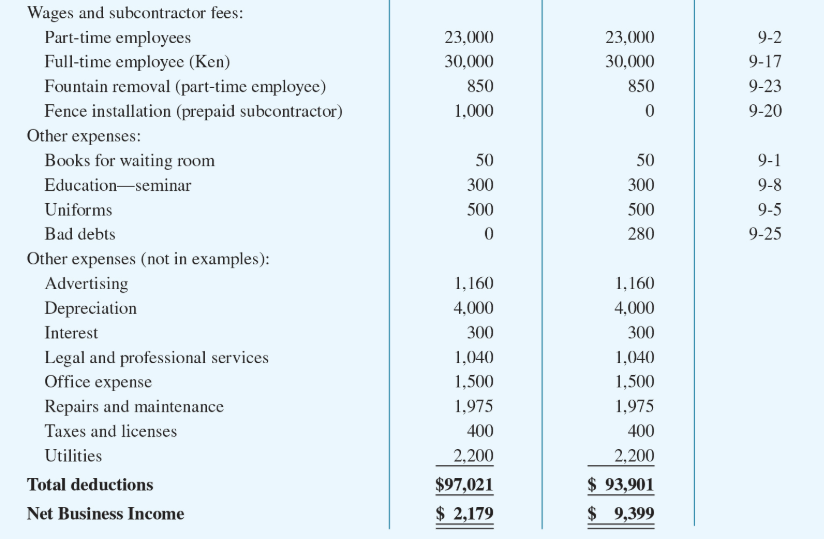

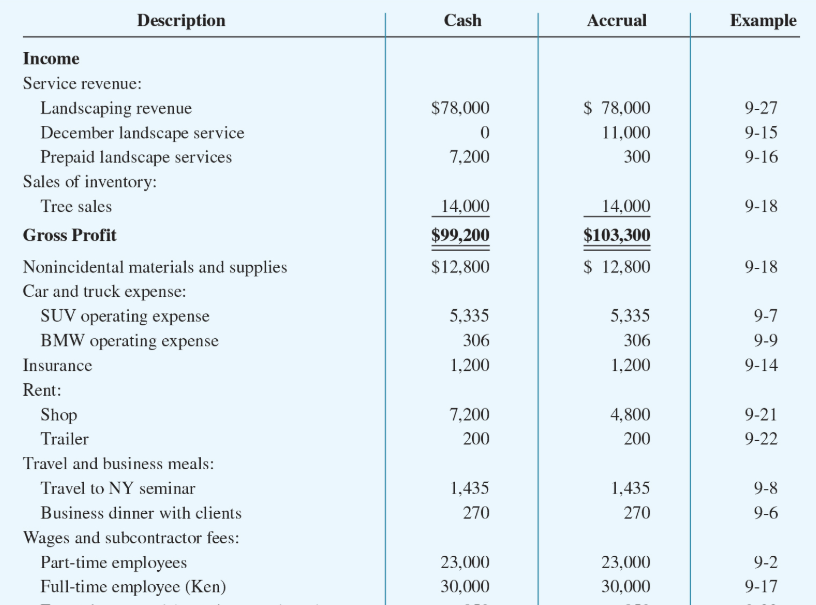

Solved Income Tax Return Problem Only Prepare Schedule C With The Detail Course Hero

1040 Schedule C Form Fill Out Irs Schedule C Tax Form 2021

How To Fill Out Schedule C Form 1040 Sole Proprietorship Taxes Youtube

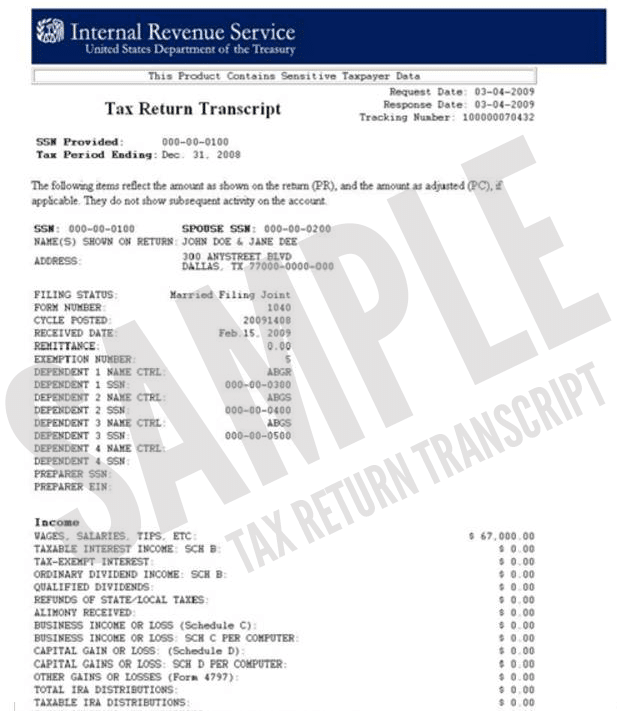

How To Get A Tax Return Transcript In 10 Minutes Shared Economy Tax

Irs Schedule C Instructions For 1099 Contractors Shared Economy Tax

Irs Schedule C 1040 Form Pdffiller

Schedule C Form 1040 Tax Return Preparation By Businessaccountant Com Youtube

Free 9 Sample Schedule C Forms In Pdf Ms Word

Irs Schedule C 1040 Form Pdffiller

Indie Authors Should Consider Using Schedule C Tax Forms Irs Tax Forms Irs